How do enhanced management features on futures trading platforms help to create profitable investing strategies?

Futures trading enables investors to profit on price movements in a variety of assets, including commodities, currencies, stock indexes, and more. While it might be dangerous, using the best investment platform in India and tools can help traders establish risk-management methods and maximize profits. Let’s look at how enhanced management tools on top futures trading platforms contribute to profitable investing strategies.

Setting the Stage for Success

The first step is to select a trustworthy investment platform that provides solid tools and services. Look for user-friendly, secure platforms that offer real-time market data and research tools. They should also provide low-cost or commission-free trades so that more of your gains remain in their account.

Advanced Charting and Technical Analysis

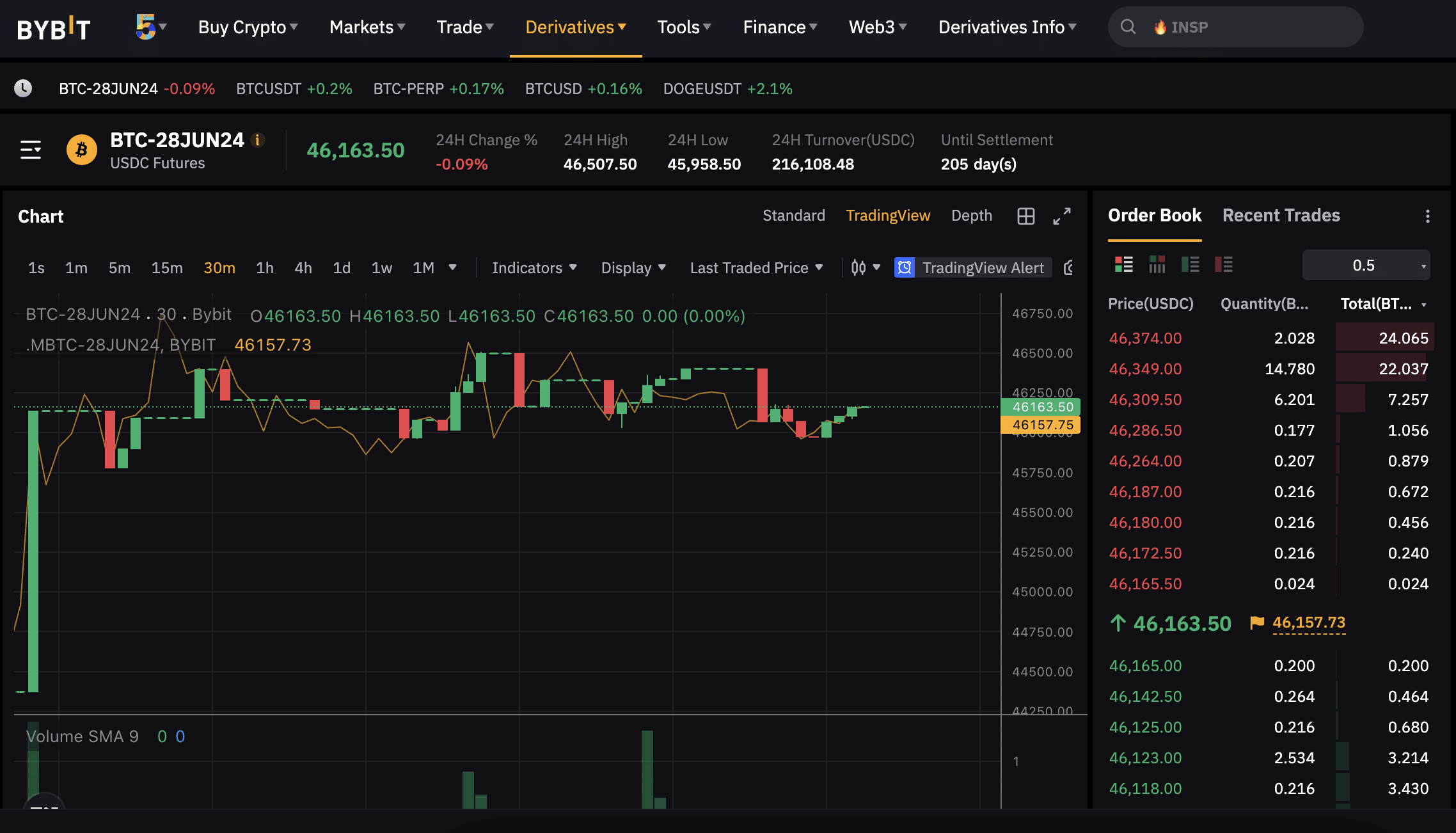

Powerful charting tools are required for technical analysis, which examines past price and volume data to discover trends and forecast future price movement. Leading systems offer customizable charts with several indicators, including moving averages, Bollinger Bands, and the Relative Strength Index. To acquire diverse viewpoints, add indicators to charts with different time frames Such as daily, weekly, or monthly.

Platforms also allow them to draw and record support and resistance levels, trendlines, Fibonacci retracements, and extensions to pinpoint entry and exit positions. Back testing trading methods utilizing historical data allow them to validate them before putting actual money at risk. Advanced charting enables technical traders to create, test, and implement effective trading strategies.

Order Types for Precise Executions

Futures markets are volatile, therefore having the appropriate order types is critical for exact trade entry and exit. Aside from standard market and limit orders, advanced order types such as one-cancels-other, fill-or-kill, and good-till-canceled orders provide traders with greater control over order execution.

Platforms also support conditional orders, such as one-triggers-other, which automatically places a second order if the first is fulfilled. This enables complicated techniques like taking a position and placing a stop loss with a single click. Trailing stops allow profits to run while automatically adjusting the stop loss as the market shifts in your favor.

Integrated Risk Management Tools

Risk management is critical since futures trading involves leverage, which can compound both gains and losses. Advanced platforms include risk management features such as position size calculators, which assist to estimate the best contract volumes based on the account type and risk tolerance.

They also provide automated stop losses for existing positions at predetermined price levels. Trailing stops, as previously stated, automatically increase the stop loss as the market swings in your favor. Some platforms even let them establish profit targets, which will automatically lock in winnings.

Automated Trading Strategies

While discretionary best online stock trading necessitates ongoing monitoring, automated or algorithmic trading strategies execute trades programmatically using predetermined criteria. Leading systems include tools for back testing, developing, optimizing, and automating trading strategies without writing code.

Indicators, filters, and conditional logic can be combined to create techniques for identifying opportunities and placing orders automatically. Strategies can be optimized by adjusting factors like entry/exit prices and stopping losses. Performance measurements aid in the refinement of strategies before their implementation for real-time trading.

Advanced Order Flow Tools

Order flow analysis examines order book data to detect order imbalances and determine trader mood. It aids in predicting short-term price swings based on the interaction of purchase and sell orders. Advanced platforms provide order flow technologies such as the ability to view order book depth with live bids and offers.

One can examine order flow data such as the volume weighted average price (VWAP), participation rate, which reflects buying/selling pressure, and order book flow, which displays the net position of new orders entering the order book. These tools provide them an advantage over other traders by detecting short-term reversals based on order flow patterns.

Customizable layouts and workspaces

Leading platforms provide fully adjustable layouts and workspaces to meet individual trading needs and preferences. You can add, remove, resize, and rearrange various widgets across many displays. For example, technical analysts may wish to have many charts with indicators in addition to order entry/position panels.

Day traders may wish to see order flow and Time & Sales widgets prominently displayed. Platforms also allow you to preserve alternative layouts for different strategies and switch between workspaces with a single click. This adaptability improves the trader interface for optimal productivity and efficiency.

Back testing and Strategy Optimization

Advanced back testing skills are critical for designing and optimizing profitable futures trading strategies. Leading platforms enable back testing strategies against large amounts of historical data, as well as altering strategy factors such as entry/exit rules and position sizing.

Traders can assess the robustness of strategies by testing them across markets, timeframes, and historical data. Maximum drawdown, risk/reward ratio, hit rate, and profit factor are all performance indicators that can be used to quantify strategy efficacy.

Platforms with genetic and Monte Carlo optimization methods go a step further. They automatically run through millions of parameter variations to find the best setting. This eliminates the need to manually back test each variable change.

Optimization refines strategies by adjusting factors such as entry/exit prices and stop losses to optimize returns while minimizing drawdowns and hazards.

Integrated News and Sentiment Tools

Staying on top of current events, geopolitical threats, and trader sentiment is critical for forecasting market movements. Advanced platforms seamlessly combine news and sentiment tracking techniques.

Traders may track breaking news headlines from trusted sources, filter by keywords, and tag content that is relevant to their holdings. Platforms also provide sentiment indicators based on social media and news mentions to help evaluate crowd feelings.

Advanced Portfolio and Risk Analysis

Sophisticated portfolio analytics tools enable traders to manage risk across all holdings from a single platform. Advanced risk measurements including value at risk (VAR), conditional VAR, drawdown, exposure, and stress testing evaluate portfolio risks in a variety of scenarios.

Traders might create “what-if” scenarios to assess the risks of proposed trades before executing them. Correlation matrices demonstrate the correlations between assets to maximize diversification. Integrated analytics offer a bird’s-eye view of performance, risks, and opportunities at both the individual trade and portfolio levels.

Conclusion

To be successful in futures trading, you must manage different risks and factors throughout time. Advanced tools on the best investment platform in India are critical for generating strong strategies, executing them precisely, managing risks holistically, and automating tactics. Technical analysts, discretionary traders, and algorithmic traders can all benefit from advanced charting, order flow analysis, order types, and configurable interfaces. Overall, employing modern platform technologies is critical for developing successful future investment strategies.

Leave a reply

You must be logged in to post a comment.